服务热线

177-5316-3001

Reference:https://mp.weixin.qq.com/s/YTTX7S0ibSv5i6Jacq8hYQ

Marine fuel prices sank due to COVID, then sharply rebounded in recent weeks

One year ago — which seems like an eternity ago — no one in ocean shipping was talking about COVID. They were talking, ad nauseum, about fuel. About a massive spike in fuel prices due to a regulatory “tsunami” that would hammer liner companies’ 2020 financial results, inflate the cost of imported goods and steer winners and losers among shipping stocks.

It didn’t happen, courtesy of COVID. Instead, the price of marine fuel collapsed. Shipowners and cargo shippers actually saved money on fuel in 2020.

The trend this year is in the opposite direction. The price of marine fuel is coming back. And so-called “scrubbers” — equipment allowing ships to legally burn cheaper, high-sulfur fuel — are starting to pay off much more than before.

Rising marine fuel prices will mean rising costs for cargo shippers and ship operators. A higher scrubber advantage will mean more upside for the shipowners like Star Bulk (NYSE: SBLK) that installed them on a large scale.

American Shipper interviewed Richard Joswick, head of oil pricing, refining and trade flow analytics at S&P Global Platts, to put 2021’s marine fuel and scrubber outlook into perspective.

Crude pulls up marine fuel

“The biggest driver, of course, is what’s going on with the overall level of the oil market,” Joswick explained. “The crude price is going up. That’s what’s responsible for the increase in bunker [marine] fuel prices more than anything else.”

The IMO 2020 rule mandates that ships without scrubbers cannot burn 3.5% sulfur fuel known as high sulfur fuel oil (HSFO). They must burn 0.5% sulfur fuel known as very low sulfur fuel oil (VLSFO) or 0.1% sulfur marine gasoil (MGO).

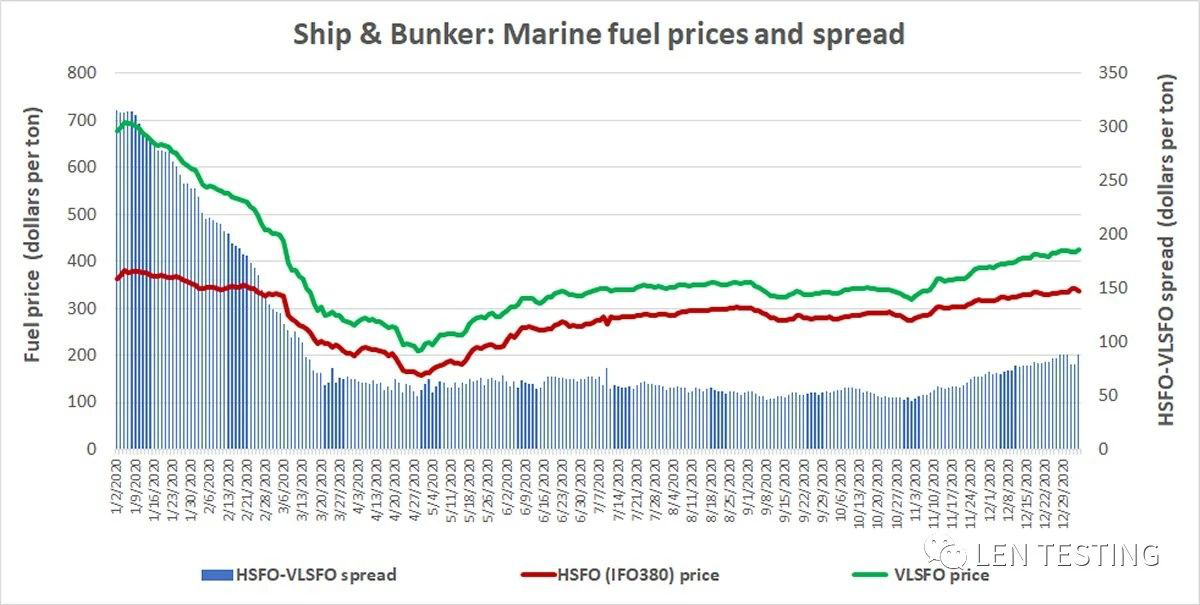

According to data from Ship & Bunker, the price of VLSFO was down to $318.50 per ton on Nov. 2, 2020. The price of HSFO (specifically IFO380 bunkers) on that date was down to $273.50/ton. The spread had shrunk to a mere $45 per ton.

Between Nov. 2 and this Thursday, the price of VLSFO increased 43%. The price of HSFO increased by 32%. The spread between the two widened by 112%, to $95.50 per ton.

(Chart data from Ship & Bunker. Note: Prices are average for top 20 global bunker hubs.)

How fuel price flows to shippers

During Q2 and Q3 2020, container lines lowered Bunker Adjustment Factors (BAFs) in shipper contracts to account for lower prices at the pump. As carriers saw revenues from spot deals surge, their revenues from contract deals fell due to lower BAFs.

“Shippers should begin to prepare for future BAF increases,” warned Sea-Intelligence CEO Alan Murphy in a report this week.

“The carriers’ different BAF structures mean they do not all adjust BAFs at the same time,” he continued. “Some do it monthly — usually based on the monthly average fuel price with a two-month time lag — and some do it quarterly.”

Because of the lag effect, Murphy sees the recent fuel-price rise affecting monthly BAFs by March and quarterly adjustments starting in April. “BAFs stand to increase significantly for Q2 2021,” he cautioned.

Cargo shippers are already facing widespread delays and uncertainties with transit times, premium charges tacked onto previously negotiated contract rates, historically high spot pricing and expectations for substantially higher annual contract pricing. Higher BAFs this year would add insult to injury.

More scrubber installations?

When the HSFO-VLSFO spread fell below $50 per ton last year, the rationale waned for installing scrubbers that each cost $1 million-$2 million. Now that the spread is back up near $100, shipowners might be tempted to look at scrubbers yet again.

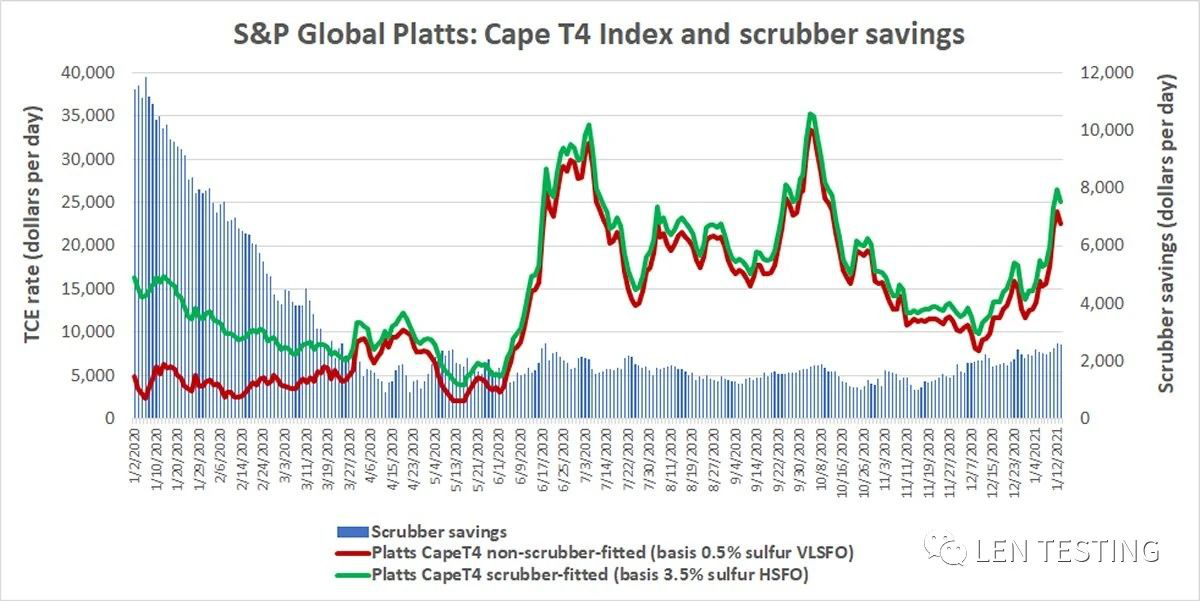

S&P Global Platts’ indices for Capesizes (dry bulk vessels with capacity of around 180,000 deadweight tons or DWT) reveal the scrubber effect on the bottom line.

According to the Platts Cape T4 Index, on Nov. 2, the day the HSFO-VLSFO spread was down to $45 per ton, Capesizes with scrubbers saved $1,121 per day versus non-scrubber Capesizes because of their ability to consume cheaper fuel. As of Wednesday, Capesizes with scrubbers saved $2,553 per day.

Over the past 10 weeks, the profit advantage of scrubber-equipped Capesizes has jumped by $1,432 per day or 128%.

(Chart data from S&P Global Platts)

According to Joswick, “With the spread near $100 a ton, people will be asking: ‘Is that enough to add a scrubber?’ My guess is that it’s probably not enough yet to put an older ship into dry dock and install a scrubber. But it might be enough if you’re building a new ship.”

Tanker, bulker scrubber use on rise

One might have thought the COVID pandemic and the collapse of the fuel spread would have been the death knell for scrubbers. It temporarily slowed the train, but scrubbers are alive and well. In fact, scrubber interest increased over the course of 2020.

According to data from Clarksons Research, 36% of very large crude carriers (VLCCs, tankers with 200,000 DWT-plus capacity) now have scrubbers, plus another 4% due for retrofits. Of VLCC newbuilds on order, 42% will have scrubbers. Altogether, including existing and ordered ships, 40% of VLCCs are set to use scrubbers. A year ago, the percentage was 35%.

For Capesize dry bulk ships, Clarksons data shows 39% of on-the-water ships with scrubbers, plus another 2% set for retrofits. Of Capesizes on order, 63% will feature scrubbers. Including existing and new ships, 42% of Capesizes are set to have scrubbers. A year ago, the percentage was 34%.

More large box ships opt for scrubbers

The container-shipping industry offers the most acute example of scrubbers’ enduring appeal.

Alphaliner reported orders for 25 ultra-large containers ships in Q4 2020. Only five of those ships opted for liquefied natural gas. The other 20 — orders for OOCL, ONE and MSC — opted for scrubbers.

According to the Clarksons data, 65% of ultra-large container ships on the water (defined by Clarksons as having 15,000 twenty-foot equivalent units of capacity or more) now have scrubbers. Another 6% of the fleet will be retrofitted. Of newbuilds on order in this category, 68% will be scrubber-equipped. Including existing and new ships, 70% of the larger container ships are set to have scrubbers. A year ago, the number was 60%.

This trend raises the question of whether cargo shippers are paying too high a BAF. What if the BAF is based on the VLSFO price but the container ship is using a scrubber and actually burning cheaper HSFO?

According to Murphy, “We might begin to see a rekindling of the discussion as to whether BAF formulas should take the scrubber-enabled vessels into account — especially in the Asia-Europe trade, where many vessels have had scrubbers installed.”

Factors affecting fuel spread

Scrubbers’ business case has improved, but not as much as it could have.

Joswick noted that today’s VLSFO price and HSFO-VLSFO spread would be higher if not for COVID restraints on air travel, which have recently intensified. “Jet fuel demand is very weak with the new lockdowns. It’s not likely to get back to normal in 2021. That’s for sure.”

Indirectly, this dynamic allows for more VLSFO supply, which puts downward pressure on pricing.

“When you lose demand for jet fuel, you can take some of the molecules that would have gone into jet fuel and put them in your diesel pool. When you do that, you now have plenty of diesel to take some of the heaviest components with higher boiling points and put those into your VLSFO,” Joswick explained.

The VLSFO price and the HSFO-VLSFO spread should increase with the recovery of air travel and demand for automotive fuels.

Meanwhile, HSFO could face downward pricing pressure in an economic recovery scenario, another plus for scrubbers.

Refinery utilization is up from its COVID nadir in Q2 2020, but it’s still low. “This is still a very difficult time for refiners,” said Joswick. “They are still running at reduced operating rates, which means they have plenty of spare capacity.” At these reduced capacity levels, refineries can economically convert HSFO into lighter products, he noted.

When refinery utilization ultimately ramps up to high levels, the refining process will create more HSFO, which will need to be converted into lighter products using more expensive means. This should put downward pressure on HSFO pricing, which would further widen the HSFO-VLSFO spread and further increase shipowner savings from scrubbers.

2021 pricing outlook: Up

“Brent went from around $40 per barrel in October to around $55 per barrel, which translated dollar-for-dollar into the price of bunker fuel. The big question is what will Brent do next,” said Joswick.

“A number of people out there are getting bullish on the price of Brent. But if you look at the supply-demand fundamentals, they’re still soft for Q1 2021. So, there’s some downside risk right now as people are enthusiastic. Fundamentals should get stronger [after Q1 2021]. There’s likely some upside risk later in the year — assuming the vaccines work.”

The implication is that marine fuel prices will rise in 2021 and the spread could widen. “But we’re not talking about a repeat of what we saw earlier,” Joswick stressed.

In January 2020, the spread surged to $315 per ton, more than triple current levels. A Capesize with a scrubber was earning $11,800 per day more per day than a Capesize without one.